Mortgage repayments for thousands of homeowners are rising. Understanding what affects the rate you’re offered when applying for a mortgage could help you secure a better deal.

As a mortgage is often one of your largest outgoings, it’s not surprising that people are worried about the cost rising. A survey conducted by Unbiased found that more than half of Brits are more worried about their mortgage repayments than anything else.

If you’re applying for a new mortgage, it can be useful to understand what could affect the rate the lender offers you. Here are four factors you need to know.

1. The Bank of England’s base rate

The Bank of England’s (BoE) base rate is the reason why many homeowners are finding their outgoings have unexpectedly increased.

Throughout 2022, inflation has been high. To tackle this, the BoE has increased its base rate. At the start of 2022, it was 0.25%, but by November 2022 it had increased to 3% through a series of rises.

So, homeowners that have a variable- or tracker-rate mortgage, where the interest rate can change during the term, have seen their mortgage repayments rise several times over the last 12 months.

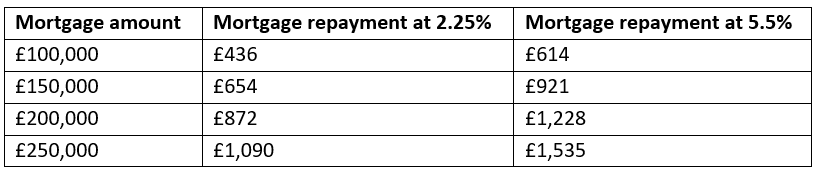

While a rise of 2.75% may seem low, it can have a significant effect on outgoings and the total cost of borrowing. The below table shows how repayments may change for a 25-year repayment mortgage.

Source: MoneySavingExpert

While homeowners with a fixed-rate mortgage may not have been affected by the rising base rate yet, outgoings could increase sharply when their current deal ends.

2. Your credit score

Your credit score can affect whether a lender approves your mortgage application and the interest rate you’re offered. So, whether you’re a first-time buyer or are remortgaging, it’s worth going through your credit report before submitting your application.

Lenders use your credit report to assess how likely you are to default on mortgage repayments. If you’re considered high risk, the interest rate you’re offered is likely to be higher to balance this.

Mortgage providers will look at whether you’ve missed payments in the past, as well as other financial commitments, such as loans or credit cards. They will also review your application history, so it’s best to avoid applying for other forms of credit when you’re getting ready to apply for a mortgage.

There may be other simple steps you can take to improve your credit score, such as registering to vote and removing inaccurate addresses.

3. Your loan-to-value ratio

Despite being worried about mortgage repayments, the Unbiased research found that half of homeowners didn’t know how much they still owed. Yet, it’s a crucial figure that could affect your interest rate.

Lenders will look at your loan-to-value (LTV) ratio when assessing your application, and it can have a direct effect on your repayments.

The LTV compares how much you owe compared to the value of your property. As you make repayments or the value of your property rises, the equity you hold will increase, and your LTV will fall.

Typically, the lower your LTV, the better the interest rate you can access. This is because, as your equity increases, you’re viewed as less of a risk.

So, when you remortgage, understanding how much you have left to pay off and your lender’s LTV bands can be useful. Making overpayments or paying off a lump sum to move into a lower band could save you money overall.

The LTV applies to first-time buyers too. While it’s common to put down a 10% deposit, if you can boost this by just 1% you could move into a lower LTV band to secure a lower rate and help your monthly budget stretch further.

4. The type of mortgage you choose

The type of mortgage you choose could also affect the interest rate you’re offered.

A fixed-rate mortgage means the interest rate will remain the same for a set period, often two, three, or five years. This can provide you with some certainty and means you don’t need to worry about rates potentially increasing, although you also wouldn’t benefit if they fell.

In return for this security, you will often find that a fixed-rate mortgage deal has a higher interest rate than a comparable tracker- or variable-rate deal.

Remember the interest rate isn’t the only thing to consider when choosing a mortgage. While a fixed-rate deal may have a higher interest rate, the stability it provides may mean it still makes sense for you.

Contact us to talk about your mortgage application

Whether you’re a first-time buyer or are remortgaging your home, please contact us. We can help you search the mortgage market for a deal that’s right for you and could secure you a competitive interest rate.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.